Choosing the Best Way to Finance Your Business (29.2)

- Thiago Casarin Lucenti

- 4 days ago

- 5 min read

Chapter 29 - Business Finance

Lesson Objective: To understand the various sources of finance available to businesses

Where does business financing come from? There are basically three different sources: internal finance, external finance, and equity finance (which is a part of external finance). Let's look into them:

Let's start by looking at Internal Sources of Finance:

Retained Profits (RE):

This is the part of the profit of the company that is kept to reinvesting (after paying shareholders' dividends and taxes).

Retained profits is a source of finance that can be used by any businesses of all sizes;

Retained profits have no costs to the business whatsoever;

It can only be used, however, by profitable businesses.

Sale of non-current (fixed) assets is another commonly used source of internal finance:

A business can sell or rent its assets to raise finance;

Businesses sometimes do 'sale and lease back' fixed assets;

Such method has no costs to the business and allows it to raise large amounts of finance;

It can, however, be disadvantageous: costs of moving, costs of leasing back, and it can be hard to find buyers at the time needed.

Some fixed assets are easy to sell (vehicles, buildings) whereas others are hard to sell (specific machines).

The use of working capital is also considered a source of internal finance:

As you know, working capital is used to cover short-term expenses of the firm.

Some businesses use this cash balance as a source of finance for different activities.

It needs to be done carefully since it may lead the business to not being able to pay its day-to-day expenses and even possible emergency expenditures (it can lead a business to bankruptcy).

Businesses can choose to reduce their inventory levels as a way to raise finance internally:

It's the concept of opportunity cost:

Reducing inventory leads to more capital / money / finance / cash to be invested in any other business activity;

Problems of reducing inventory: not being able to meet demand, loss of sales, reputation, market share, idling resources.

Finally, by reducing the amount of trade receivables companies can raise a high degree of finance internally:

By shortening credit/payment terms to consumers companies will be bringing in more cash (finance) to the business - it can lead to reduced sales due to competition;

Companies can also employ a more efficient system for chasing debtors in order to raise finance from trade receivables.

To summarize, internal sources of finance are those that the business can take on themselves without needing to go to external parties;

Internal sources of finance do not have direct costs to the business.

We shall now discuss external sources of finance, which can increase the business' debts and liabilities and can be divided into two types (a.k.a. Debt Finance):

Short-term external finance include overdraft, trade credit, debt factoring;

Long-term external finance include bank loan, hire purchase, leasing, mortgage, debenture, share issue.

Overdraft:

A 'type of short-term loan';

It allows the customer/business to keep on paying its bills even when the account reaches zero;

It acts as an emergency;

The limit is pre-agreed;

It usually carries high interest.

Trade Credit:

The payment terms offered by suppliers to the business - usually businesses want to delay payments to suppliers as much as possible so that they can have less working capital attached to the operations.

However, suppliers will likely try to shorten payment terms:

Suppliers usually offer discounts for early payments and businesses using of trade credit will not benefit from those;

Suppliers may not agree to deliver goods until payment is made;

Businesses that take advantage of trade credit may be required by suppliers to make early payments.

Debt Factoring:

The act of selling trade receivables for a discounted price to debt-factoring businesses.

It allows to immediate access to financing;

However, it eats up some of the profit margin from the business.

Going now into long-term external finance:

Bank Loan: the most common source of external finance:

It can be with a fixed interest, which is advantageous for its predictability;

It can be with variable interest (which goes up and down according to economic factors);

Not readily available to small businesses (high-risk businesses);

When available to small businesses they usually carry high-interests and the need for collateral.

Leasing: a common form of financing for non-current assets (e.g. vehicles, machinery):

Firm pays fixed amount to the leasing company to make use of the asset for a given time;

The firm doesn’t own the asset by the end of the leasing period (which is returned to the leasing company).

Hire Purchase:

Similar to leasing but by the end of the contract the business owns the asset.

Leasing and Hire Purchase both have the same purpose: allowing the business to have access to a non-current (fixed) asset without having to make a large one-off cash investment - the cost is spread out overtime. It is accompanied by interest, though.

Mortgage:

External source of finance for the purchase of properties/real estate;

It comes with interest rate.

Debenture:

A bond issued by businesses;

Buyers (holders) are entitled of a fixed interest through the time of the contract;

The investors' initial investment is paid back to them at the end of the contract period;

Businesses unable to payback investors may go through asset liquidation.

Government Grants:

Incentives towards boosting business activity and growth;

It comes in various forms: tax benefits, renting benefits, etc.;

It does not need to be repaid.

Venture Capital:

- Individuals or organizations willing to lend money to high-risk businesses with high-growth potential;

- More traditional methods of finance may not be available due to the risk factor;

- Risk can be related to a new technology being developed by the business;

- Venture capitalists make such investments expecting a share of future profits or a large stake in the enterprise ownership.

Activity 29.3

Crowdfunding (e.g. Kickstarter):

Using small amounts of capital from a large amount of individuals willing to "chip in";

Considered a risky investment (high failure rate);

When successful the "investors" can get their investment back with interest, a share of the company's profits, or even a stake in the business ownership;

Creates publicity around the future new product;

Makes the idea available for competitors before the product is launched;

Microfinancing is a common form of finance in developing economies:

Targeted to small entrepreneurs with no personal savings and who banks are not willing to lend (too risky);

Usually to be repaid within 6 months and once repaid made available to other borrowers;

In some cases they may be accompanied of high interest rates.

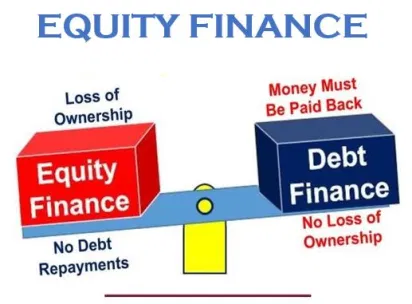

Finally, we have equity finance, yet another external source of finance: when a company decides to raise capital by selling shares (becoming a private limited or public limited company) for a part/portion of the company:

A company can raise equity finance by:

Listing the company on the Stock Exchange and become a public limited company (which is a very costly and time consuming process) or;

Listing the company on the Alternative Investment Market, which has much less regulations and it's a lot less costly than the Stock Exchange but has a limit on the amount that can be raised.

As you can see, Debt Finance and Equity Finance are very different on their workings. Which one should a business choose?

Activity 29.5

Factors to consider when choosing the appropriate source of finance:

To-Do-List:

AS Level Exam-Style Questions - Essay Question (1b, 2a)

Chapter 29 - Business Finance

Comments