Balance Sheet (a.k.a. Statement of Financial Position) (22.1)

- Thiago Casarin Lucenti

- Sep 11, 2025

- 2 min read

Chapter 22 - Balance Sheets

Learning Objective: To understand the uses and how to analyze Balance Sheets

After Cash Flow Forecast and Income Statement it's finally time to dive in to the Balance Sheet, also known as the Statement of Financial Position.

Assets: any resources owned by the company and can be divided in two parts:

- Current Assets: cash or any resource expected to be converted into cash within the next 12 months (e.g. inventories/stock, trade receivables (debtors));

- Non Current Assets (Fixed): any resources owned by the business that is expected to be used within a period longer than 12 months (e.g. land, building, machinery, computers, vehicles).

Liabilities: amount owed by the business to any stakeholder (suppliers, lenders):

- Current Liabilities: needs to be paid within the next 12 months (e.g. trade payables, overdrafts, taxation);

- Non-Current Liabilities: long-term debts (>12 months) such as loans, mortgages, debentures).

Owner's Equity (a.k.a. Shareholder's Equity):

- Amount of investment in the business by its owners;

- Includes the money brought in by owners (share capital) and retained profits.

- It's the left over to the owner after subtracting all the liabilities from assets.

A snapshot of the business' current financial position showing its assets, liabilities, and owner's equity at a certain moment in time:

This statement is useful for stakeholders to get information on the business financial health as well as how the business finances itself.

Note: Public Limited Companies must release a Statement of Financial Position early.

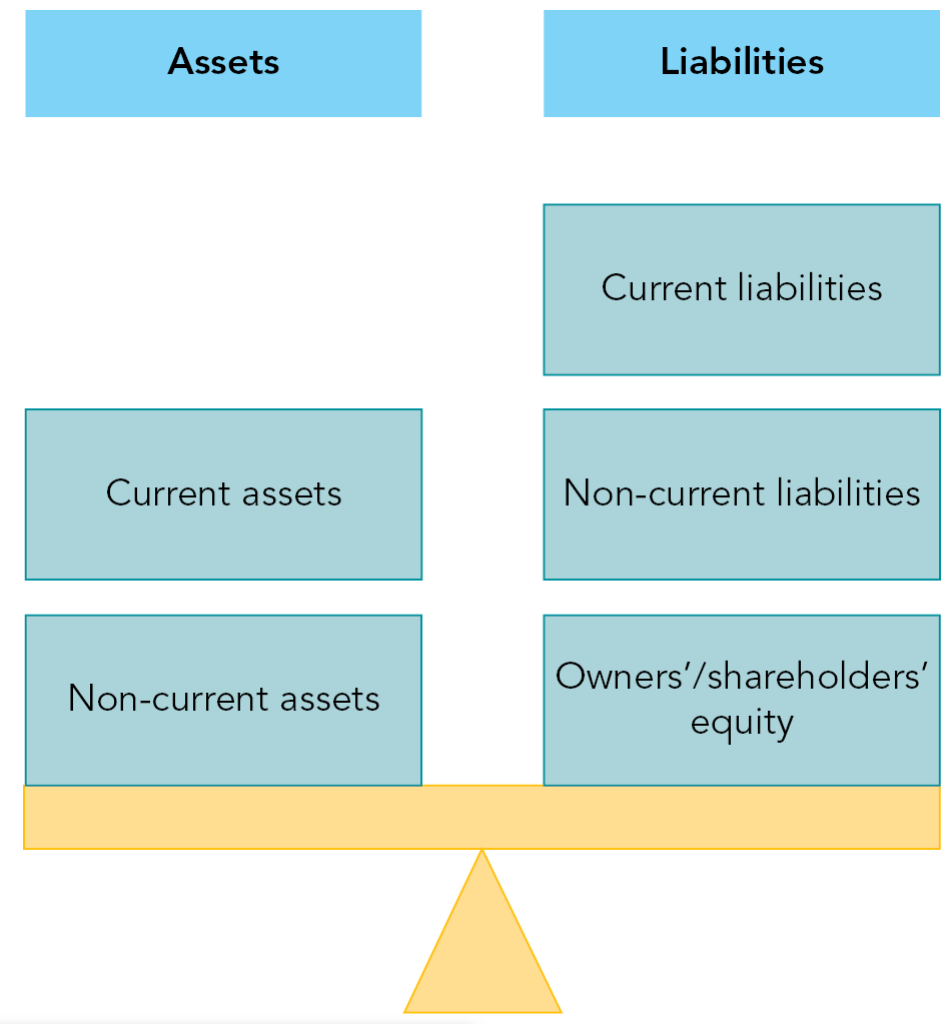

Try visualizing it here:

Activity 22.2 (p. 279)

Very important to keep in mind:

The Statement of Financial position is also known as Balance Sheet for a reason:

Always:

Assets = Liabilities + Shareholder's Equity

Why?

Assets represent the valuable resources owned by the company. Both liabilities and shareholders' equity represent how the assets of a company are financed.

Summary - Balance Sheet Considerations:

It shows the business' assets, what it is owed, what it owes, and how it finances its activities;

It is a snapshot of a point in time and can change quickly;

Non-current assets valuations can be inaccurate from real market valuation (e.g. building, land, machinery);

It is not an accurate measure of business value.

Important Formulas to Remember:

- Working Capital = Current Assets - Current Liabilities

It shows whether the business can fund its current operations and invest in future growth;

- Capital Employed = Owner's Equity + Long Term Liabilities

Important ratio to keep in mind - it measures the business profitability given the amount invested in it.

Test Yourself (p. 279)

Activity 22.3 (p. 280/281)

To-Do-List

Exam Practice Questions (p. 282)

Chapter 22 - Balance Sheets

Comments