Monetary and Fiscal Policies (24.2)

- Thiago Casarin Lucenti

- Oct 5, 2025

- 3 min read

By now you should know the four main economic objectives governments have:

To have a positive balance of payments (BOP)

To have a controlled (low) inflation rate

To have a low unemployment rate

To experience economic growth (GDP)

You should also be familiar with the Business Cycle, which is made out of:

Growth

Boom

Recession

Slump

Let's now start looking at how governments' policies can influence a country's economy. We will mostly focus on two types of policies:

Monetary Policies, that have to do with Interest Rates;

Fiscal Policies, related to Tax Rates and Government Spending.

Note:

Both of these policies are used by governments with the intention of achieving their economic objectives.

Monetary Policies is basically 'playing with interest rates' to achieve economic objectives by reducing the money supply in an economy.

First of all, what is the interest rate? There are two sides to it:

It impacts how much a company/individual will gain from having money deposited in the bank (savings);

As well as how much it will cost a company/individual to borrow from the bank (debt).

When the government increases interest rate in an economy - many consequences follow:

Reduced business/economic activity due:

Individuals and businesses are more likely to invest on savings and less likely to borrow;

Large amounts of savings strengthen the local currency (exchange rate): imported goods become cheaper;

Businesses invest less in local production because imported goods are cheap.

Lowering the interest rate would have the opposite impacts:

- Economic growth can be boosted:

- Individuals and businesses are more likely to invest than saving;

- Currency depreciates (exchange rate);

- Imports become more expensive and local investment goes up;

- Country's exports become more competitive internationally;

- Cost of borrowing decreases.

Let's now jump in to Fiscal Policies, which is basically "playing with taxation to influence economic growth" as well as managing the government spending.

Taxes can be of two types: direct and indirect:

Direct Taxes include:

Income Tax: taxing individuals and companies incomes, which reduces disposable income;

Corporate Tax: taxing corporate profits, which decreases the profit after taxes of companies.

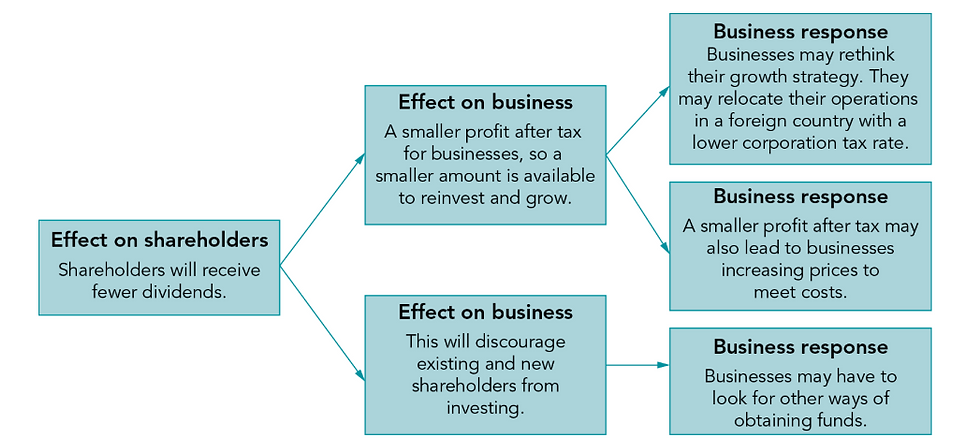

Such direct taxes impact both: businesses and its various stakeholders:

Businesses will have lower retained profits for reinvesting (lower investments);

Businesses will have less profit for paying dividends (discourage existing and new shareholders);

Businesses may consider relocating to lower tax countries;

Lower profits may lead businesses to raise prices;

External finance may become necessary as retained profits are no longer a feasible source of finance.

Activities 24.2 and 24.3.

Indirect Taxes, on the other hand, can be:

- Value Added Taxes (VAT): added on specific products/services making them more expensive (less accessible) forcing businesses to decrease production or increase prices;

- Import Taxes / Custom Duty: tariffs on imported goods which can either benefit or harm (e.g. imported retailers or importers of raw materials) local business;

- Sales Tax: on some products/services at the moment of sale;

- Excise Duty: taxes paid by manufacturers to produce those goods within the country (e.g. alcohol, tobacco).

Fiscal Policies are not all about taxation - they also include government spending decisions - let's take Mongolia's Government Spending for 2021 as an example:

Such investments in different areas (e.g. education, health, infrastructure) are funded by tax revenue.

Governments might increase their spending to boost the economy:

Creates jobs;

Increase demand for goods and services from businesses.

When it comes to Fiscal Policies, therefore, governments can either go with a expansionary or a contractionary policy:

Expansionary (reducing taxes and increasing spending):

Focused on increasing economic activity;

More investments from businesses;

Higher demand from customers.

Contractionary (increasing taxes and decreasing spending):

Focused on reducing economic activity;

Lower investments from businesses);

Lower demand from customers.

To-Do-List:

Exam Practice Questions (p. 311 and 312)

Chapter 24, Government Economic Objectives and Policies

Comments