What Type of Business Fits You Best? (4.1)

- Thiago Casarin Lucenti

- Oct 5, 2025

- 3 min read

Chapter 4 - Types of Business Organization

Lesson Objective: To understand the different types of organizations businesses can have.

There are several different possibilities of structure a company in the private sector can have. Choosing the right one will depend on the nature and purpose of the business activity and it is of vital importance for the business itself.

A sole trader is the most common and the simplest structure a business can have:

Sole Traders are single business owners who may or may not employ additional staff. They are mostly small in size but large in importance for the overall economy.

One of Sole Traders most important characteristics is that they have unlimited liability. This means that if the small business comes to fail the owner/founder is responsible for all of its debts and losses and his/her personal wealth can be used for paying off the debt.

Other disadvantages of a Sole Trader include: the difficulty in raise financing (interest, collaterals); the intense competition from larger firms; the lack of continuity given the attachment of the business to its owner; and finally

Setting up a Sole Trader structure, however, is simple and quick. The owner/founder has full control over the business and all profits are kept by him/her. A Sole Trader usually chooses to do something that interests him/her and have the ability to choose the patterns of work (e.g. working time). Finally, because they are small businesses, Sole Traders are able to develop closer relationships with customers and staff (if any).

Partnerships are an alternative to Sole Traders as it erases some of its main challenges: raising finance and spreading risks:

Partnerships are formed by two or more 'partners' to carry on a business together. The partners usually share capital investment (easier to raise finance), and responsibilities (less overwhelming). Partners are usually specialized in different aspects of the business (e.g. marketing, finance) bringing an advantage of Sole Traders. The decision-making is also shared making it less stressful.

In Partnerships profits are shared between partners - which is an important disadvantage when compared to Sole Traders.

At the same time, owners do not have independence on decision-making which can bring up conflicts among the people involved in the business.

It is important to notice that Partnerships have unlimited liability too. The difference is that losses (risks) are shared between the partners.

We will now switch gears from unincorporated businesses to talking about incorporated businesses (limited companies) - the businesses with limited liability, legal personality, and continuity:

Limited Companies' ownership is divided into small units (shares) which can be acquired by individuals (shareholders). The more shares a shareholder owns the more influence they have on company's decisions (board of directors). Shareholders with over 50% of a company's share have decision-making power. Shareholders are interested in share value and dividends.

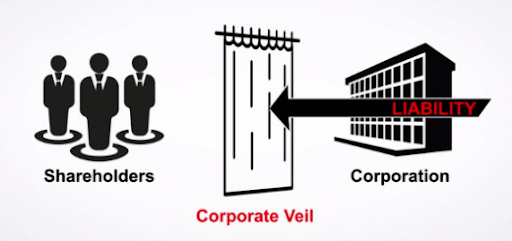

A crucial difference between Unincorporated Businesses and Limited Liability Businesses is the LIMITED LIABILITY itself:

In the case of a Limited Liability Corporation (LLC) going bankruptcy shareholders' personal wealth is kept untouched and their only loss is their investment in that particular business. This makes it easier for these businesses to attract investors (less risky) but particularly risky for creditors (suppliers and lenders).

Limited Liability Companies have another special characteristic: Legal Personality:

In other words, the company's legal identity is a complete separate identity from its owners, investors, and shareholders. The business itself is responsible for problems and can even be taken to court. Managers and workers are only responsible for bad faith actions or braking the laws.

Finally, continuity: the fact that a limited company will not be dissolved in case of an investor’s death or sickness.

Now that the 3 mains characteristics (limited liability, legal personality, and continuity) of Limited Companies are clear it is time for us to look at the two different types of Limited Companies:

Private Limited Company is a structured used by small and medium-sized businesses to enjoy of some of the advantages of being a limited company. It doesn't come without its disadvantages, though:

The Public Limited structure is the most common form of legal organization for large businesses because they can have access to large funds for expansion:

Apart from all the benefits of a Private Limited Company, a Public Limited Company can sell shares to the general public through the stock exchange leading to an increased ability to raise finance and to shareholders being able to easily and quickly sell their shares. The main problem with such structure is the phenomena of short-termism which commonly happens due to the clear split between ownership and control on these corporations.

It is also important noticing that becoming a Public Limited Company is no easy job: there are many laws regulating this process which can be expensive and time-consuming.

To-Do List:

Activity 4.2 (p. 50)

Chapter 4 - Types of Business Organization

Comments