The Use of Accounting Data and Ratio Analysis (36.1)

- Thiago Casarin Lucenti

- Dec 2, 2025

- 5 min read

Chapter 36 - Finance and Accounting Strategy

Lesson Objective: To understand the potential interpretations of published accounts and ratios

We have learned many financial and accounting data that are key for strategic decision-making. They include:

Profitability and financial performance metrics (Ch. 34) including ratios and financial statements;

Assessment of the availability of sources of finance given liquidity ratios as well as the gearing ratio of businesses.

Financial and accounting data can also be compared with other businesses to assess the success of a company's current strategies. How can such comparisons be performed?

Trend Analysis and Inter-Firm Comparisons:

- Profitability;

- Liquidity;

- Financial efficiency and gearing;

- Investor ratios and how interesting (or not) investing in the business has become.

Mixing and matching against previous time-periods and other businesses in the industry.

The development of business strategies starts with an analysis of the company's accounts to potentially highlight issues:

Example 1: Consider the data below as well as the fact that the ratios shown have also decreased when compared to competitors in the industry:

Potential strategies to be adopted given the scenario include:

Reducing overhead expenses by delayering;

Increase promotional spending to improve brand identity, generate loyalty, and allow price increases to less price-sensitive customers (C.O.A).

Discussion: evaluate the two strategies mentioned above.

Example 2: The company's gearing ratio is higher than most of the competitors:

Potential strategies to be adopted given the scenario include:

Reduce outflows by cutting on dividends to increase R.E. and be able to repay outstanding debt;

Delay payments to suppliers to decrease outflows and repay outstanding debt.

Discussion: evaluate the two strategies mentioned above.

Example 3: A home office retailer selling to retailers wishing to improve financial efficiency:

Potential strategies to be adopted given the scenario include:

Introduce JIT and switch to suppliers prepared to fulfil small orders;

Switch to online sales so that trade credit given to customers is erased (cash sales only).

Discussion: evaluate the two strategies mentioned above.

All of the decisions reached through the discussions based on ratios although valuable, should not be final:

Further analysis on the problems highlighted by the ratios should be conducted;

Assessment of the resources available for the new strategy to be undertaken;

How the new strategies under evaluation relate (or not) to the business objectives.

In other words, ratios are useful but further investigation should take place.

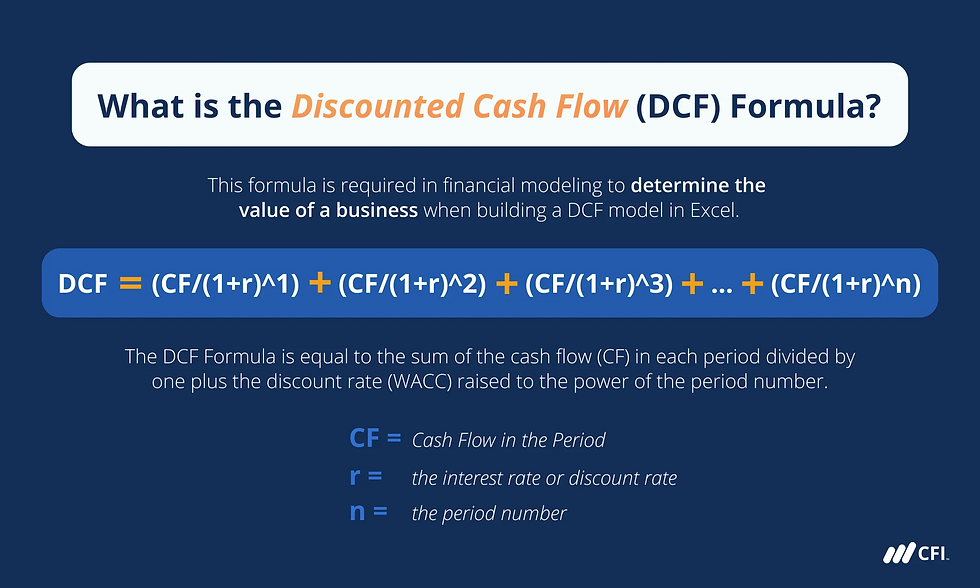

A large part of business strategy goes around the availability of finance to undertake them. New strategies usually require large amounts of funding. The two main sources of long-term finance for businesses are bank loans (debt) or share issue (equity). Whether a business will decide to go with one or the other will heavily impact on ratio results.

Scenario 1:

Plan to build wind turbine factory (demand is increasing) with the latest technology to create high productivity;

Economic activity is peaking and inflation is high;

Strategy cost: $14m and finance is required;

Current gearing ratio is 54.2% and if debt finance is used it will increase:

G.R. = (79 / 134) * 100

G.R. = 59%

If equity finance is used the impact on the gearing ratio is the opposite:

G.R. = (65 / 134) * 100

G.R. = 48.5%

Additional points to consider:

- It's a time of peaking economic activity in which inflation is high - it should be a hint that interest rates will raise making debt finance more expensive;

- If the strategy turns out successful and debt finance is used shareholders will be pleased as profits will increase and would not need to be distributed to even more investors.

Discussion: should the business go with debt or equity finance?

Companies also make dividends strategy depending on the profit after taxes, liquidity, and the impact of share issue on share prices.

Scenario 2:

A company has been paying high dividends in recent years since additional shares have been issued and the management wanted to keep share prices at the same level;

Profits after taxes have fallen in the last three years;

P/E Ratio 12 months ago was 9 and the dividend yield was 3.5%;

Earnings per share is predicted to fall to $1 next year;

The plan is to reduce dividend per share to $0.35.

If the share price remains the same...

DYR = (0.35 / 12) * 100

DYR = 2.9%

And...

P/E Ratio = 12 / 1

P/E Ratio = 12

Discussion:

Reasons why the share price is unlike to remain the same?

The impact of a lower-dividend strategy on the company's shareholders?

Business growth, a common objective for strategies, also impact ratio results due to potential economies of scale as well as how the growth is financed:

Scenario 1:

A company is planning on the takeover of a competitor which will nearly double the business size generating many economies of scale;

Rationalization will take place through the closing down of some factories (reduction of operating expenses and consequentially lower fixed unit cost);

Non-current assets of the factories closed will be sold off and used to pay part of the debt used for the takeover.

Discussion:

What will happen to the gearing ratio following the takeover through debt?

Operating profit margins?

RoCE? If the profits of the new business is more than twice as much compared to before the takeover?

How about to liquidity given the sale of fixed assets?

Businesses can adopt many different strategies - each of which will have different impacts on ratios and financial statements (also depending on how they are financed). This is an attempt to explain potential consequences of different strategies on such ratios and statements:

Important Note:

An excellent way to demonstrate evaluation is to make a clear distinction between the impact of a new business strategy on ratios in the short term compared to the long term.

Limitation of Ratio Analysis:

They are not useful unless inter-firm comparisons or trend analysis are made;

Inter-firm comparisons should take into account the different companies' financial years due to consider for the impact of rapid economic changes;

Trend analysis should take into account different circumstances at different timings;

Companies value their assets differently and depreciation calculations can also be different which impact certain ratios (also watch for window dressing);

Non-numerical aspects are not considered in ratios (e.g. customer loyalty, environmental policies, etc.);

Ratios are great tools to help diagnosing a problem - they do not show the specific and direct cause of the product neither they offer solutions;

Ratios and statements are historical data and not indication of future performance;

Knowledge-based companies may seem undervalued as intangible assets are rarely rightly valued;

Also, published accounts may be inaccurate:

- Although published accounts are reviewed by independent accountants sometimes judgements and estimations are necessary (value of assets, inventory valuation.

Window dressing can happen in different ways:

- Selling assets at the end of a fiscal year to improve liquidity;

- Reduce depreciation on fixed assets to increase assets valuation;

- Ignoring potential bad debts - trade receivables might never get paid;

- Purpose inflation of inventory values;

- Delaying payments (costs and expenses) until after accounts are published.

Summary: published accounts and ratios should be analyzed with caution. Such numerical data are a good starting point to analyze performance.

To-Do-List: Decision-Making Questions (ZenCO Construction)

Chapter 36 - Finance and Accounting Strategy

Comments