Location Decisions - Factors to Consider (26.1)

- Thiago Casarin Lucenti

- Oct 13, 2025

- 4 min read

Chapter 26 - Location and Scale

Learning Objective: To understand the factors impacting location decisions

One of the most important operations decisions a business will have to make has to do with location.

There are both, quantitative and qualitative factors that should be taken into account when making location decisions. There are also different techniques that can be employed for such decisions.

Location decisions are so important for different reasons:

They are long-term strategic decisions with widespread impacts over the business;

They are difficult to reverse given its costs;

They are high-level decisions that are not delegated to subordinates.

Let's start by looking over the quantitative/measurable factors influencing location decisions:

1. Cost and 2. Revenue are two obvious influences:

Location is one of the highest fixed-costs a business has;

The revenue potential of a location is also impacted - closely related to convenience provided to customers (e.g. coffee shops, restaurants, hotels, etc.).

Status also relates to revenue potential (e.g. clothing brand at the Paris Fashion Street or a bank in Wall Street.

3. Transportation Costs:

Transportation of raw materials and parts to the business:

- Manufacturing businesses tend to locate operations near suppliers (costs)

Transportation of finished goods to customers:

- Ability to quickly and cheaply ship to customers.

4. Labor Cost:

Labor intensive operations are better off locating in places where labor costs are lower.

5. Government Grants:

Governments try to encourage businesses to set up operations in certain locations (regions, countries):

- Is the grant advantageous?

- Although advantageous, will setting up operations in that location a smart long-term decision?

There are, therefore, 5 quantitative factors impacting location decisions. How do you decide?

There are a few techniques that assist this decision making:

1. Profit Estimates: comparing how much profit each option might be able to generate to the business.

Any problems with that?

It doesn't consider the capital cost of buying or developing the location.

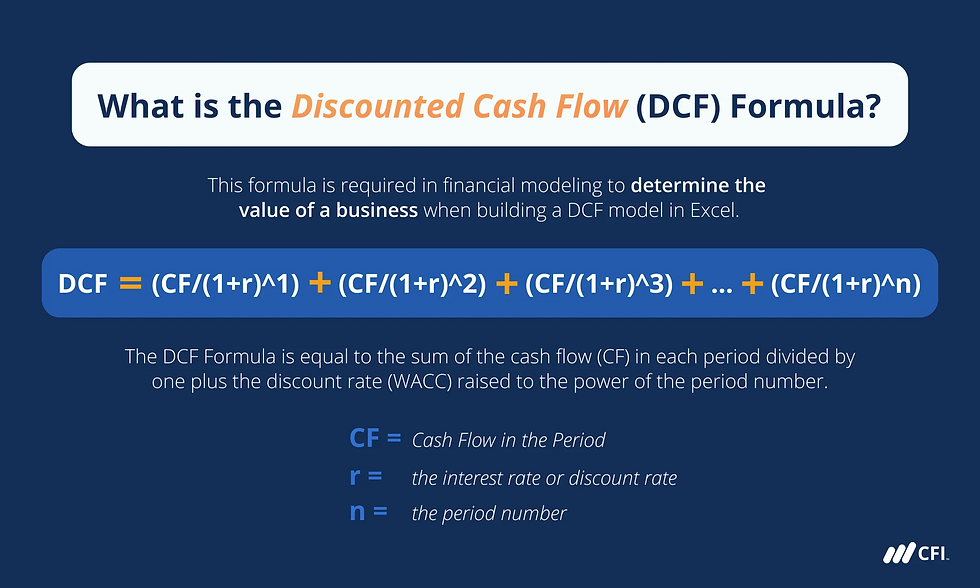

2. Investment Appraisal: looking at the potential return different options will provide the business with:

- The most common one is payback time: how long will the initial investment take to be covered by the business' profits.

Limitation: for an appraisal to be possible there needs to be estimates of revenues and costs on all the potential locations: it can be inaccurate.

3. Break-Even Analysis:

- The calculation of how much should be produced and sold in each location-option so that total costs are covered for;

- The lower the amount needed to be produced and sold to cover for total costs the better it is.

There are also non-measurable (qualitative) factors businesses need to take into account when making location decisions:

Safety: industrial plants are located in the suburbs although it may increase transportation costs;

Room for further expansion: long-term factor (relocation is costly);

Ethical factors: environmental and social aspects may hurt a business reputation;

Infrastructure: availability of communication and transportation (ports, airports, roads, railways, IT structure, etc.).

Some final considerations / additional issues on location decisions:

Market-Pull Demand may influence on location decision-making although less important nowadays due to advancements in communication and transportation - brick and mortar presence is no longer necessary;

Planning Restrictions are becoming more common and businesses need to take those into consideration;

External Economies of Scale - cost reductions encountered when the industry grows in one specific region:

Technology industry in Silicon Valley - the region brings many benefits to businesses in the industry:

Talent attraction/creation: universities and tech-heads attracted to the area;

Easy access to suppliers: nearby qualified suppliers are readily available;

Cooperation / Join-Venture Opportunities: Google and Intel have cooperated in many projects.

There are also the so called diseconomies of scale:

If an industry continues to grow in one location it can lead to cost increases for businesses. There will be increased demand for land or property and increased demand for suitable labour. These demand pressures will cause unit costs to rise for businesses in the industry operating in this location.

You should also know the 5 internal economies of scale.

Location decisions are extremely complex: choosing the optimal location is challenging. Some businesses adopt a multi-site location strategy for that reason - advantages:

- Customer Convenience: product/service availability in multiple locations make it easy to access for customers;

- Lower Transportation Costs: a regional warehouse can serve multiple locations;

- Reduced risk of disruption: if an event takes place in one location and disrupts operations other locations are still able to continue running;

- Opportunity for regional delegation: regional leaders can be created which increases motivation and skills of local managers.

Are there any problems with multi-site location strategy?

- Communication and coordination problems may lead to diseconomies of scale;

- Potential lack of control from the headquarters can negatively impact operations;

- Different legal and cultural systems requires adaption;

- Cannibalism can happen if branches are placed too close.

Chapter 26 - Location and Scale

Comments