Shareholders' Ratios (34.3)

- Thiago Casarin Lucenti

- Nov 17, 2025

- 5 min read

Chapter 34 - Analysis of Published Accounts

Learning Objective: To understand the many different shareholders' / investment ratios

Although not directly considered an investment ratio, gearing ratio is still an important number existing and potential shareholders will look at when making their investment decisions.

Taking out loans (debt) isn't necessarily something negative. Loans are a method of financing which can lead to profitable investments (e.g. expansion). However, the more debt a business has, the higher the risk the business accepts carrying on.

The gearing ratio comes in to measure the degree to which the capital of a business is financed through debts (loans). Businesses that have a high percentage of their capital from debt are said to be highly geared.

Gearing Ratio Formula:

Example:

Understanding the results:

PLS is less dependent on loans as a source of finance than BSK, which is a less risky strategy. However, this result may also show that PLS may be losing on some business opportunities which BSK might have identified and therefore rip less benefits/profits in the future.

Points to Note:

A result higher than 50% would mean highly geared businesses;

The higher this ratio, the higher the risk to shareholders investing in this business will have, because:

- High debts = high interest payments and therefore lower retained earnings and dividends (specially problematic with high interest loans);

- Interest and repayments should continue even if profits are falling (may require further capital injection from shareholders);

- High debt can be a sign of low liquidity.

Although a low gearing ratio is a safer strategy but a slower-growth one. Some investors may be willing to withhold the higher risks of highly geared businesses if the reason for the debt is expansion.

Methods for Improving Gearing:

Raise equity finance to reduce debt finance (pay loans):

- Will dilute ownership per share;

- Dividends payment will have to increase to maintain the same rate of payment to shareholders;

- May not be a good idea depending on economic factors (price per share may be low);

Reduce dividends to retain more profit to finance debt payments:

- Shareholders return decreases;

- Some businesses may be turning insufficient profits for this to work;

Sell assets to raise finance and pay debts;

- If needed to be done quickly prices of assets will likely be low;

- Will reduce the business' value;

- Limits the business ability to expand (unless the assets are no longer needed).

Now we dive in to the, officially, so called, Investment Ratios where we will be discussing the three most common calculations shareholders will make to decide their investments based on their potential returns:

Dividend Yield Ratio

Dividend Per Share

Dividend Cover Ratio

Price/Earnings Ratio

Earnings Per Share

Remember: shareholders' return come from two sources: capital gains and dividends. The ratios mentioned give indicators of gains on both.

1) Dividend Yield Ratio a financial metric that indicates the annual dividend income a shareholder can expect to receive from an investment, expressed as a percentage of the investment's current market price. In simpler terms, it's a way to measure how much money you could make in dividends relative to the cost of the investment:

Where 2) Dividend Per Share is calculated by:

Example:

Shareholders on PLS are gaining higher return on their investment than the ones from BSK. This is just one of the indicators to which is a better investment and other ratios need to be looked over for a informed decision to be made.

If share prices rise, the dividend yield ratio will fall;

If dividends increase but share prices remain the same, dividend yield ratio increases;

Shareholders will compare this number with the rate of return of other investments (e.g. bank interest rates and other businesses' dividend yields);

An effective comparison of these results will be by using past record and other businesses in the same industry;

Shareholders are attracted by high dividend yield if share prices are not predicted to fall quickly;

Directors may decide to keep dividends even if a company makes a loss to keep shareholders' loyalty;

Directors may decided to reduce dividends to increase retained earnings (plan for expansion) even if profits are higher;

A high dividend yield ratio is not an indicator of a good investment necessarily: maybe it is high due to a steep decline in share prices which can make the investment unattractive.

3) Dividend Cover Ratio shows how many times dividends could be paid out of the profit for the year.

The higher this ratio, the more able the company is to pay its proposed dividends;

A high dividend cover ratio leaves margin for retained earnings to take place (re-investing).

Example:

Shareholders can notice from this result that BSK could have paid much more dividends;

It also indicates that they may be retaining high levels of profits for reinvesting (future capital gains);

If dividends increase and profits don't it indicates to potential new shareholders that this level of dividends may not be sustainable in the long-run;

A low result indicates low retained profits which can raise questions regarding the company's future expansion plans.

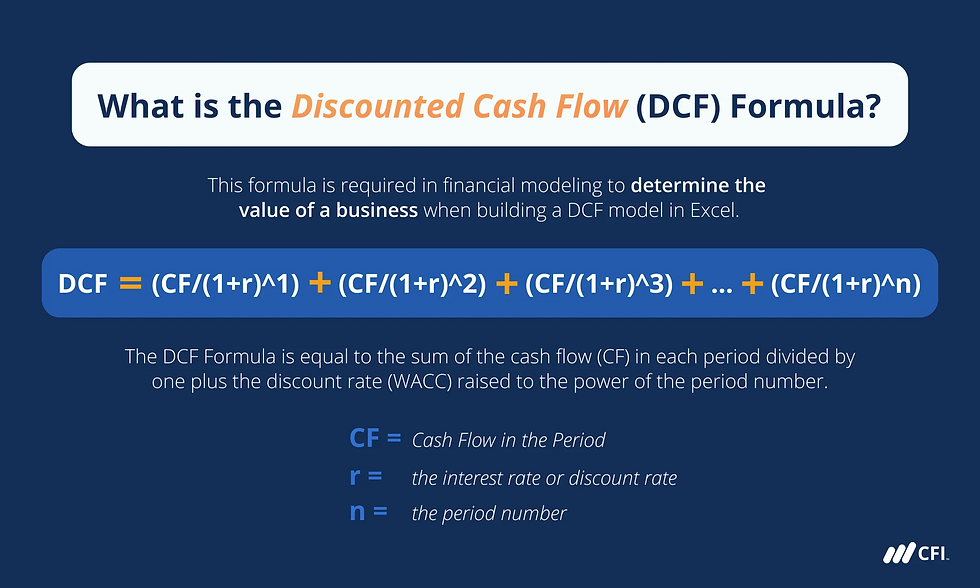

4) Price/Earnings Ratio compares a company's current stock price to its earnings per share (EPS). P/E ratio suggests how shareholders expectations regarding the company's future earnings are like:

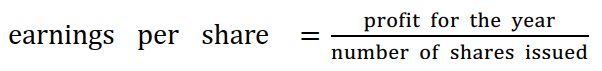

Where 5) Earnings Per Share are calculated by:

A high P/E ratio suggests that investors have high expectations for future earnings growth, but it can also signal that the stock is overpriced relative to the company's current earnings;

A low P/E ratio suggests that investors have low expectations for future earnings growth, but it can also signal that the stock is undervalued relative to the company's current earnings.

When a high P/E might be okay?

High-growth industries: Companies in rapidly growing industries might have higher P/E ratios due to investor optimism about future potential;

Quality companies: A well-managed company with strong competitive advantages might justify a higher P/E ratio.

It is always important to compare a company's P/E ratio to others within its industry!

Example:

Now that you understand the many Investors' Ratios and how important they are, let's look into how companies can try to improve those which basically goes around improving profits:

Higher profits is likely to lead an increase in share prices and dividends.

To increase profits, however, companies will:

Invest in non-current assets;

Require higher retained earnings for internal financing (reduced dividends in the short-term).

Chapter 34 - Analysis of Published Accounts

To-Do-List: Activity 34.7

Comments