Statement of Financial Position Amendments (33.2)

- Thiago Casarin Lucenti

- Nov 6, 2025

- 4 min read

Chapter 33 - Financial Statements

Learning Objectives: To understand the Statement of Financial Position

The aim for most businesses is to increase shareholders' equity. This is done by increasing the value of the business' assets at a higher rate than the increase in liabilities.

The Statement of Financial Position is there to record such net wealth (shareholders' equity) at one moment in time. Shareholders' Equity comes from two main sources:

It is, therefore:

- The amount of investment in the business from its owners (shareholders) - so called share capital or common stocks;

- The left over after liabilities are subtracted from assets (retained earnings).

Here is a heartbreaking truth for all of you who thought Retained Earnings = Cash:

Retained earnings are the accumulated profits that remain in your business after all costs have been paid and all distributions have been paid out to shareholders year-after-year.

Retained earnings aren't the same as cash or your business bank account balance:

Cash | Retained Earnings | |

Definition | Portion of a business's earnings that remain after paying all costs and distributing profits to shareholders; | The money a business has available to spend; |

Balance Sheet | Listed in the equity section; | Listed under current assets; |

Impact | Affected by the company's net profits or losses; | Affected by cash inflows and outflows; |

Purpose | Used to support business growth (investments); | Used to pay for expenses. |

The contents of a Statement of Financial Position are:

Companies are required to publish this statement for the last fiscal year as well as make it easy for stakeholders to compare;

This is a momentaneous statement: it provides information on the value of the company at that specific moment (whereas the Statement of Profit or Loss provides data for the whole year).

Let's dive in to the other several parts of the Statement of Financial Position:

- Non-Current Assets are those that the company will make use of for longer periods of time (>12 months):

-- It includes tangible assets such as cars, land, machines, buildings;

-- As well as intangible assets, those that although cannot be seen or touched still have value to the business:

Notes on Intangible Assets:

- They are difficult to value / measure;

- They are just recorded on the Statement of Financial position if/when the company is acquired (takeover or merger).

Examples:

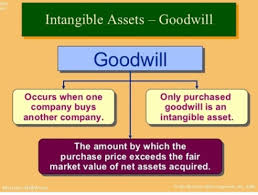

Goodwill:

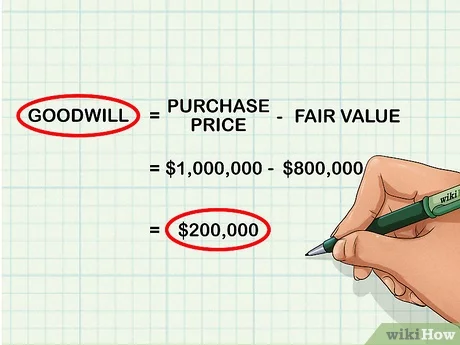

The value of a business is not dictated exclusively by its assets. Goodwill refers to a business intangible assets, specially related to the business reputation in the market.

Goodwill is amended to the statement when the business is being prepared for sale or it has already been sold for more than the value of all of its assets combined (this is the goodwill itself). These are the only situations in which goodwill is included in the statement.

Businesses that are well-known, well-established, and with good trade links (customers and suppliers) are the ones that carry goodwill value (i.e. reputation);

Why do you think goodwill is not counted as an asset on the Statement of Financial Position?

This is because goodwill is hard to value and can quickly change/disappear.

Goodwill will appear on the Statement of Financial Position of a business that has bought another firm and paid goodwill; and should be written off quickly after.

But how can intangible assets such as patents, copyrights, and branding valued though?

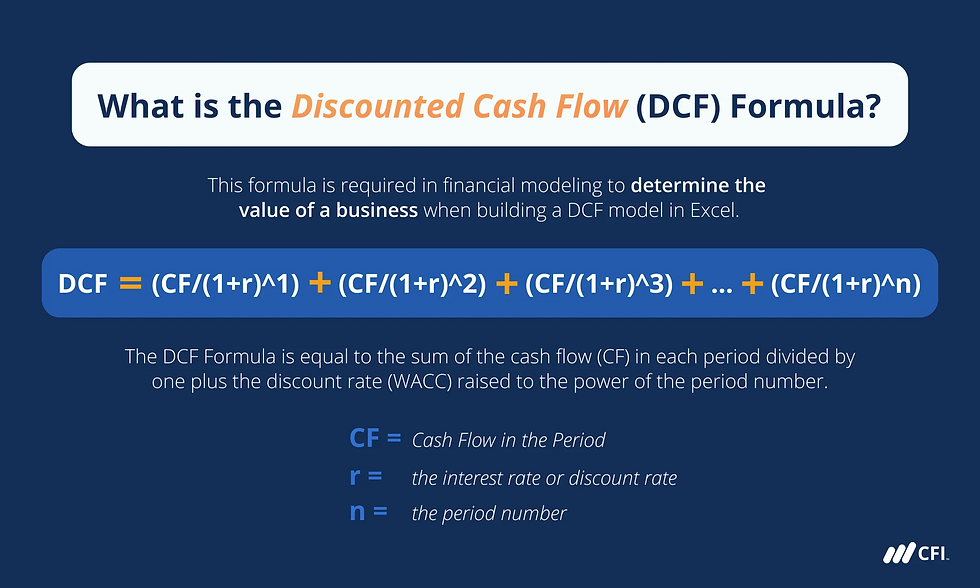

To be valuable, intangible assets should generate some measurable amount of economic benefit to the business;

Such economic benefits can be in the form of incremental revenues (due to pricing, and volume, for example), cost savings (e.g. economies of scale, marketing cost savings), or increased market share and visibility;

Similarly to goodwill, other intangible assets also don't make it to the Statement of Financial Position unless the business is prepared to be sold off or has being acquired (e.g. brand recognition, trademarks, customer loyalty, patents).

Some companies have a considerably higher market value than their book value (which is their net asset value).

Here are some examples:

Tesla's market value is immensely larger than any other auto-manufacturer.

Looking at units sold or book value, however, Tesla is nowhere near other car makers.

Going back to the different parts of the Statement of Financial Position:

- Current Assets, on the other hand, are the ones that can be turned into cash quickly (<12 months) and are an important measure of business liquidity (financial health): cash, receivables, bank balance).

The same split (current and non-current) happens with liabilities:

Current Liabilities are those expenses that are expected to be paid by the business within the next 12 months:

- Short-term loans;

- Accounts payable;

- Overdrafts;

- Taxes;

- Expenses.

Non-Current Liabilities are those expected to be paid by the business in more than 12 months:

- Long-Term Loans;

- Leasing;

- Hire Purchase;

- Mortgage;

- Long-Term Payables.

Finally, the Working Capital is an indirect part of the Statement of Financial Position as it can be easily calculated using the information available on the statement:

Business in Action 33.2 - Discussion

Activity 33.6 (Q1)

A Statement of Financial Position is usually prepared as an amendment to the previous year statement. There are many amendments possible to this statement:

Amendments on the Statement of Financial Position require the double-entry principle to be applied:

Total Assets = Total Liabilities + Shareholders' Equity

ALWAYS!

Keep the same structure through the amendments.

Business in Action 33.7

Wrapping up... The relationship between the two statements:

Chapter 33 - Financial Statements

Comments