Strategic Analysis Tools (8.2)

- Thiago Casarin Lucenti

- Sep 2, 2025

- 5 min read

As we all know there are three main stages on formulating a Corporate Strategy. We will now start focusing on the first one - Strategic Analysis:

Strategic Analysis is the process of conducting research into the business environment within which an organization operates, and into the organization itself, to help form future strategies.

Strategic Analysis answers three big questions:

Where is the business now?

How might the business be affected by what is happening or likely to happen?

How could the business respond to these likely changes?

A well-conducted Strategic Analysis leads to clearer and more relevant goals as well as better-quality strategic decisions with lower risk of failure.

We will learn four techniques for Strategic Analysis:

SWOT Analysis;

PEST Analysis

Porter's 5 Forces Analysis;

Core Competencies Analysis

Ansoff Matrix.

A SWOT Analysis focuses on providing information that can be helpful in matching the firm’s resources and strengths to the competitive environment in which it operates:

A SWOT Analysis takes on external and internal factors as well as helpful and harmful ones:

Strengths are internal factors that can be used to create a competitive advantage; Weaknesses are negative internal aspects that can be limiting to the business;

Opportunities: are found through an external audit of the market to identify areas of potential profits;

Threats: external analysis focused on competitors' strengths and/or any market situation that can be adverse.

- Business may need to overcome weaknesses to take advantage of opportunities;

- SWOT is a starting point for formulation of Corporate Strategy - but not sufficient;

- SWOT is considered a subjective analysis (non-quantitative) and therefore should be used for finding a common ground among managers and not as a prescription for strategy.

Note: Some questions may ask you to undertake a SWOT analysis, while others will ask you to evaluate the technique for a particular business. Read the question carefully to grasp its key requirements.

Activity 8.4

PEST Analysis is another widely used technique for Strategic Analysis of the business' macroenvironment - political, economical, social, technological:

PEST Analysis has its own specific considerations:

The main goal of PEST is to assess the likely chances of a business strategy being successful given the external environment;

Each of the PEST elements can be an opportunity or threat to the Corporate Strategy, complementing a SWOT Analysis;

PEST needs to be constantly updated and reviewed, especially in a rapidly changing environments;

Multinational businesses need to perform PEST Analysis for each market as its elements are area-specific.

Business in Action 8.2

A third strategic analysis tool is Porter's 5 Forces - this analysis is based on the understanding that there are mainly 5 forces influencing the attractiveness of an industry/market to a business and such forces dictate the dynamics (attractiveness) of that industry.

The tool assists managers to understand and establish a competitive advantage over the competition in the market.

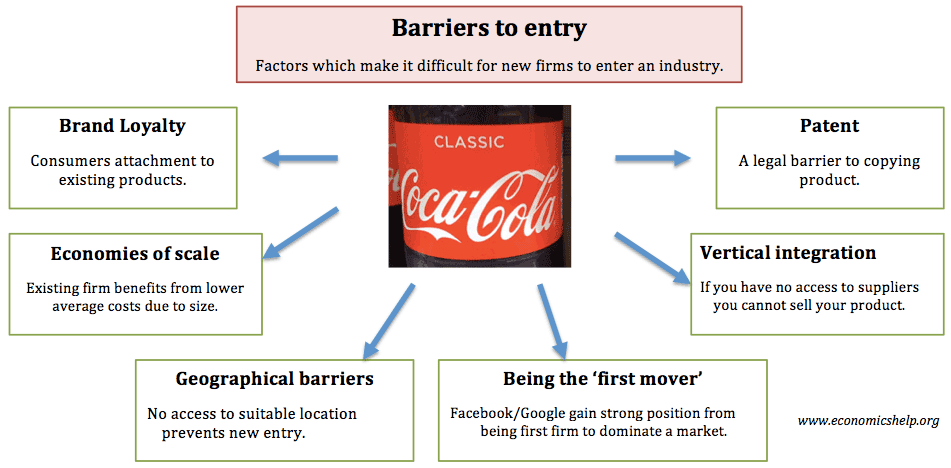

The first force influencing on an industry is the Threat of New Entrants - Barriers to Entry:

This force refers to the ease which other firms may have when trying to enter and compete in the industry:

The higher the barriers the better for businesses in the industry.

Next, Threat of Substitutes or the Availability of Substitutes:

The more substitutes for a product/business the less power it commands in the industry and over customers;

More substitutes mean customers have the ability and ease to quickly switch.

The Bargain Power of Buyers also heavily influences on the attractiveness of an industry:

The ability buyers have over influencing price and quantity of products sold by a firm;

The more bargain power buyers have, the more susceptible the business is - and vice-versa.

Likewise, the Bargain Power of Suppliers plays an important role in a business profitability:

The more power a supplier has over a firm the less profitable that business might be;

Suppliers with high power may dictate the success (or not) of a firm.

Finally, the Competition/Rivalry has a great impact over profitability and attractiveness of an industry:

The level of competition within the industry influences the business ability of making profit for obvious reasons.

How is this analysis helpful for corporate strategic decisions?

Assessment on whether or not a market is worth it entering (industry profitability);

Evaluation on whether the existing market is still interesting given the level of competitiveness and ways of improving profitability in it;

Aids competitive position decisions such as product differentiation, takeover decisions, segmentation and target decisions.

Evaluation of Porter's 5 Forces Model:

It is a good starting point for further analysis as it allows for an overview of the industry's current situation;

It's a static analysis and therefore should not be basis for decision in fast-changing industries;

It can become complex in industries where many segments are present and they all have their own specifications (forces).

Core Competencies:

Still part of Strategic Analysis is the concept of Core Competencies - an important business capability that can give firms competitive advantage over the competition.

Core Competencies can be varied and in different functions. However, 'it's not like any core competency will fit any business':

For a Core Competency to actually have value it should aid profitability and be commercially viable to the business. For that reason, Core Competencies should:

Provide recognizable benefits to consumers;

Not be easily replicable (e.g. patented design);

Be applicable to a range of different markets and products - not specific to one.

Core Competencies lead to the development of Core Products: products and services that give the business a competitive advantage over other businesses and are important for the long-term growth of the company (products not necessarily bought and used by end-customers).

For example, Black & Decker, it is claimed, has a core competence in the design and manufacture of small electric motors. These core products are used in a huge variety of different applications from power tools, such as drills, to lawnmowers and food processors.

Developing Core Competencies:

- Integration of technologies and product skills that are likely already within the business organization;

- It doesn't necessarily mean high R&D investment;

- Core Competencies create opportunities for Core Products which then can be developed into End Products and new markets.

Example of what's not a core competency: A computer assembly business might be very efficient and produce computers at low cost, but if it depends on easily available and cheap bought-in components from suppliers, this is not a core competence. It does not make the business very different from many other computer assembly firms.

To-Do-List:

Chapter 8 - Business Strategy

Comments